Empowering Ag Retailers: Credit and Rebill for Closed Periods

Levridge 2025 Release 2 introduces Credit and Rebill for Closed Periods. Users perform credit or credit-and-rebill operations even after a financial period closes, streamlining adjustments and reducing administrative headaches with this new functionality.

The Challenge: Adjustments After Closed Periods

In the ag sales industry, purchases are frequently made months before growers have the time to review their invoices. Once the harvest is over and growers review their accounts, they may discover the need for changes—such as returns, adjustments to splits, or the application of bookings and prepayments. However, by this time, the ag retailer has likely already closed the relevant financial periods in their accounting system to keep the business running smoothly. Traditionally, making these post-period adjustments has been a cumbersome process.

The Solution: Levridge 2025 Release 2

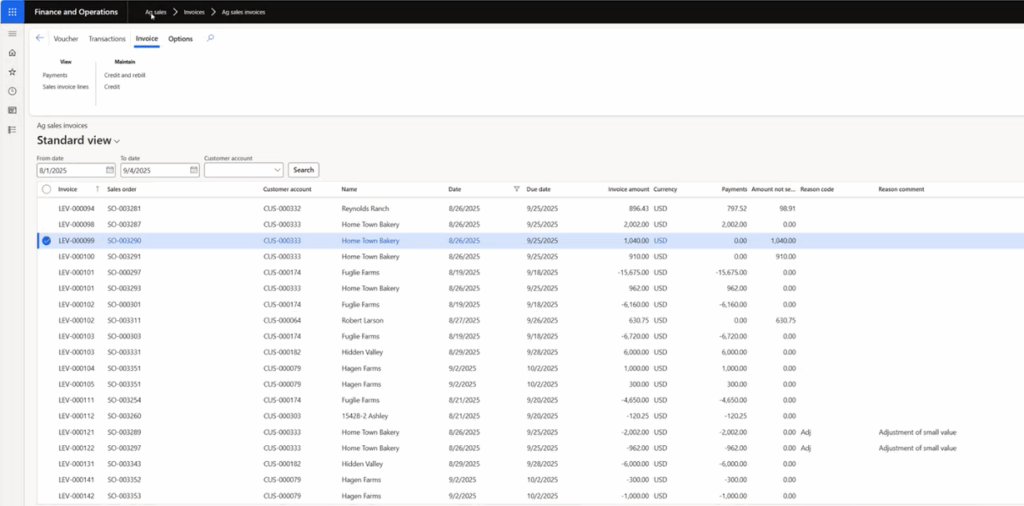

To navigate, go to Ag sales > Invoices > Ag sales

How It Works

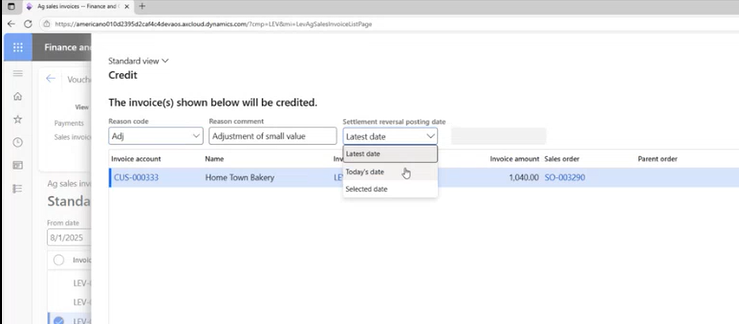

- Flexible Settlement Reversal Posting Date: When performing a credit or credit-and-rebill, users can now select a settlement reversal posting date. Users can post adjustments to a date that works for both the grower and the retailer, without reopening closed periods

- Multiple Date Options: Users have the flexibility to choose from several posting date options:

- Latest Date: Automatically selects the most recent allowable date.

- Today’s Date: Posts the adjustment as of the current day.

- Selected Date: Allows the user to manually choose any date that fits their business requirements.

- Streamlined Workflow: The process is straightforward. From the Ag Sales Invoices menu, users select the invoice, choose their reason code, and then pick the appropriate posting date for the credit or credit-and-rebill action.

Why This Matters

This enhancement is a direct response to the realities faced by ag retailers and growers. Levridge 2025 Release 2 allows users to make adjustments after periods are closed, ensuring financial records stay accurate and up to date—even when business cycles don’t align perfectly with accounting timelines

For ag retailers, this means less time spent on administrative workarounds and more time focusing on supporting their growers and driving business success. Growers actively review their invoices with greater flexibility and confidence, knowing their accounts are accurate.

By bridging the gap between business operations and accounting processes, this feature helps ag retailers and growers work smarter—ensuring the rewards of a successful season.

Additional Resources

Accompanying YouTube video

More information on Ag Sales, visit Ag Sales Solution