Tracking Returns in Levridge: The Credit and Rebill Process

When it comes to handling customer returns or issuing sales credits, understanding the underlying reason is crucial. Whether the return is prompted by product defects, unused items, or billing errors, it’s important to track the specific cause behind the sales credit or return.

Levridge AgSales offers a comprehensive set of features that streamline the entire sales credit/return and rebill process. With Levridge version 2023 R3, you can now track the reason for the sales invoice credit/return.

How to Use the Credit and Rebill Process in Levridge

1. Set Up Reason Codes

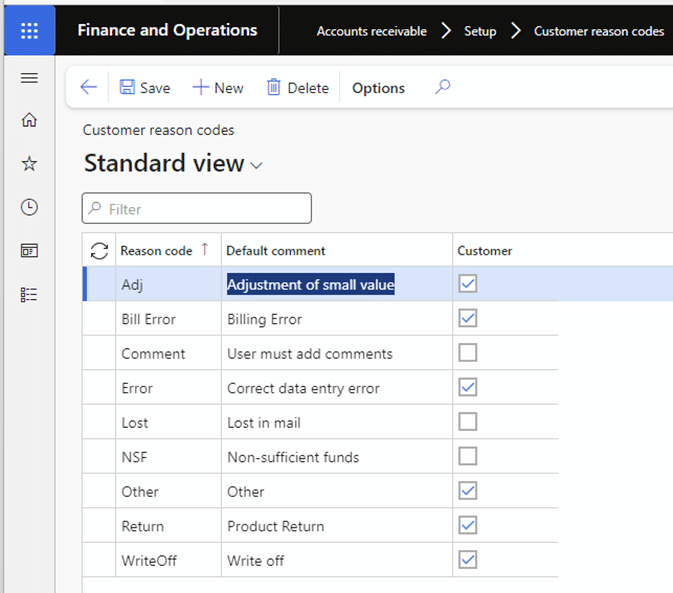

The first step is to set up reason codes. Navigate to: Accounts receivable > Setup > Customer reason codes. To set up a new customer reason code, click New, then enter the Reason code and the Default comment.

Make sure to check the “Customer” Checkbox so that the reason shows up during the return process.

2. Find the Sales Invoice

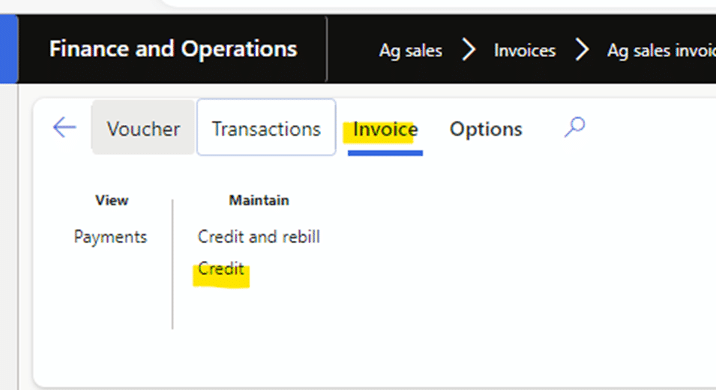

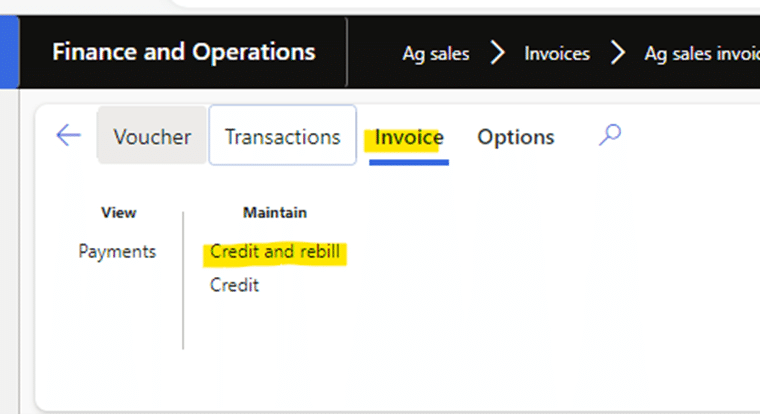

Next, find the sales invoice you’d like to return by going to AgSales> Invoices > Agsales invoices.

3. Credit or Credit and Rebill

If you’d like to just credit/return the invoice, select “Credit” from the menu bar.

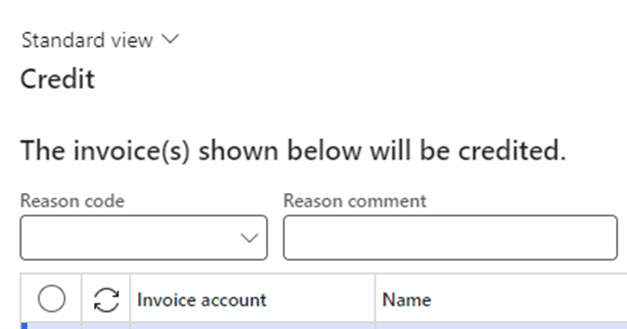

You can then choose the reason code from the slider.

If you would like to credit and rebill the invoice, select the “Credit and rebill” option.

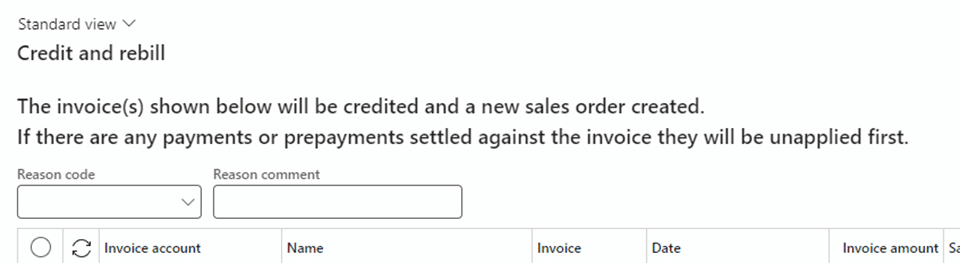

Then you can select the reason code.

Following these steps, you’ll be able to track why invoices were credited.