Multicurrency Mark-to-Market Calculations

The Levridge Commodity Accounting 2024 release 2.0 supports multicurrency transactions in mark-to-market gain and loss calculations. To demonstrate how this works, let’s walk through an example where a company in the United States enters into a purchase contract for canola, with the pricing set in CAD.

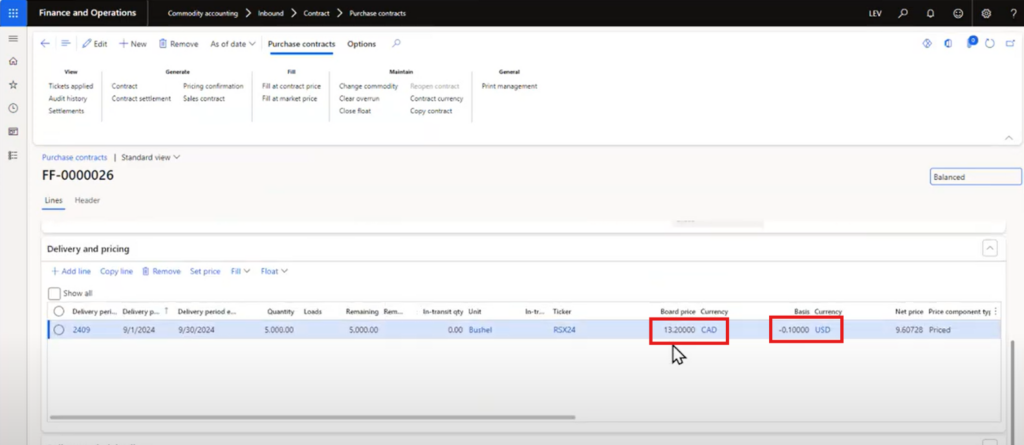

In this case, the contract specifies a price of CAD 13.20 per bushel, but the company records its accounting in USD.

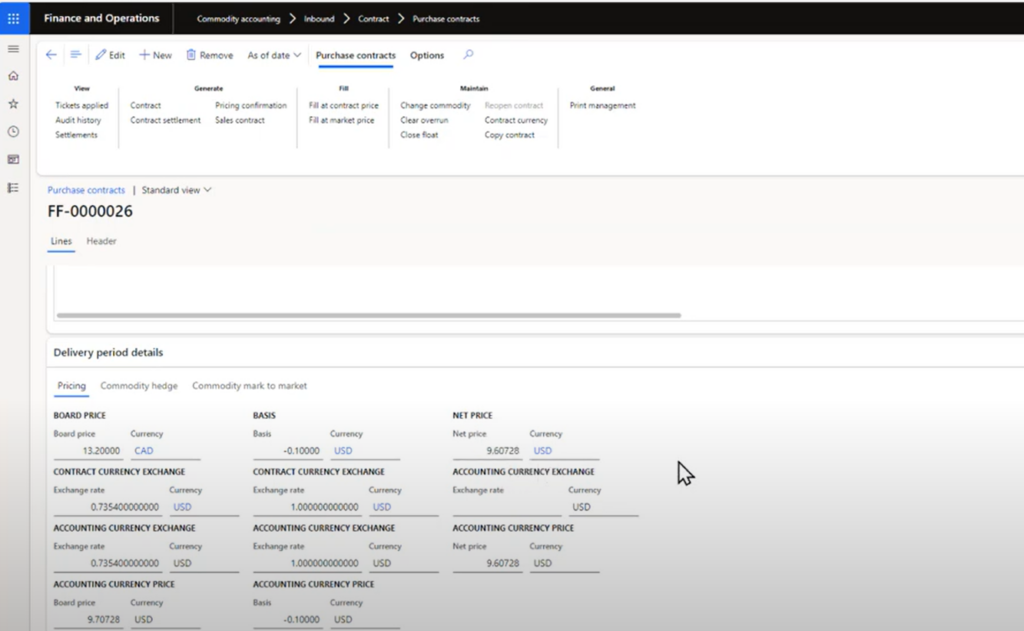

The system automatically converts the Canadian dollar value using an exchange rate of 0.7354, which was the rate at the time of the contract. This conversion results in a USD price of approximately $9.71 per bushel. Additionally, the basis price in the system is set at USD -$0.10, meaning that the contract’s final net price comes to $9.61 per bushel in USD, with no exchange rate conversion necessary for the basis.

How the System Handles Multicurrency Transactions

One of the key advantages of Levridge 2024 R2 is its ability to handle contracts with a mix of currencies. In this example, even though the contract is priced in CAD, the system calculates both the original contract price and the mark-to-market price in USD, ensuring that the gain or loss reflects the current exchange rates.

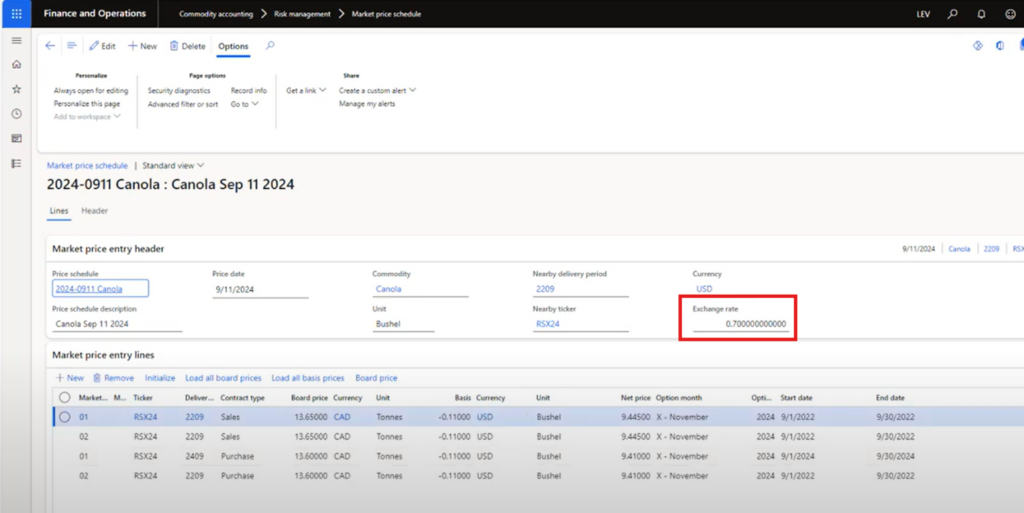

When it’s time to run the mark-to-market report, the system retrieves the market price for canola in CAD and applies the updated exchange rate of 0.7, reflecting any currency fluctuations since the contract was signed. As the exchange rate has changed from 0.7354 to 0.7, the new market price of CAD 13.60 per bushel translates to USD 9.52. This discrepancy between the contract price and the market price causes a loss in the company’s books due to the change in the exchange rate.

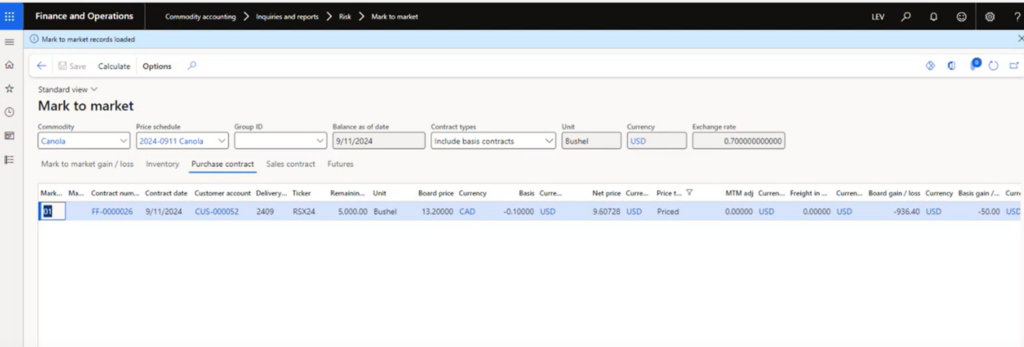

Calculation Breakdown: Gain and Loss

The system then calculates the gain or loss by comparing the contract price with the current market price. In this example, the contract price in USD was $9.61, while the market price in USD is now $9.52. After deducting the original contract price from the current market price, the system determines a loss of $0.09 per bushel. With an open contract of 5,000 bushels, this results in a total loss of $936.40 on the board price. A similar process is followed to calculate the loss on the basis, which, in this case, is an additional $50 loss.

This ability to handle multiple currencies efficiently ensures that businesses can monitor and adjust for currency fluctuations, gaining a clear and accurate picture of their financial position at any given time.