Understanding Provisional Invoicing in Levridge

The Spring 2024 update to Levridge, introduces a powerful new feature: provisional invoicing. This functionality is particularly valuable in industries like ethanol production, where the final price of a product is often determined after the shipment has been delivered.

What is Provisional Invoicing?

Provisional invoicing allows businesses to issue an initial invoice for a nominal amount at the time of shipment, with a final invoice issued later to reflect the actual price. This process is particularly useful when the final price is dependent on market conditions or other factors that are determined after the product has been delivered.

Setting Up Provisional Invoicing in

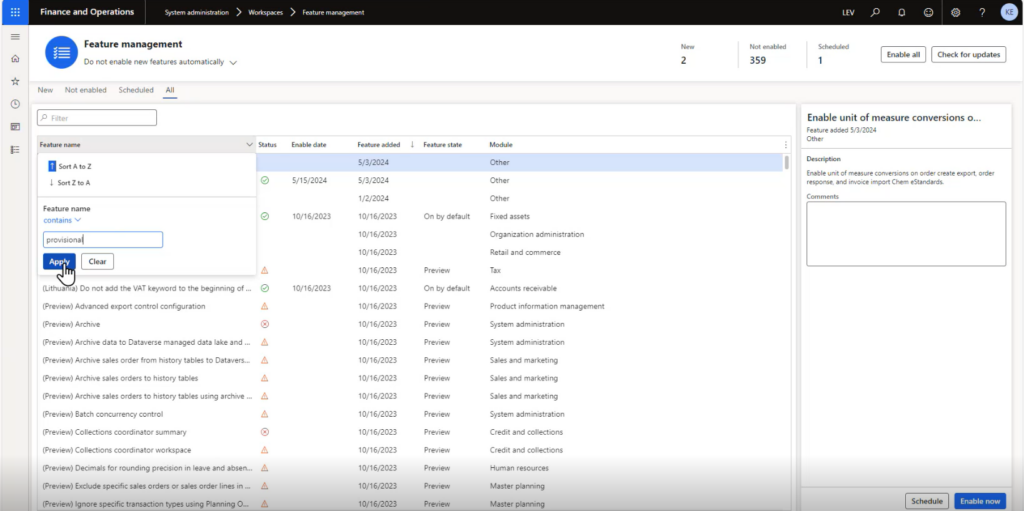

To use provisional invoicing, it must first be enabled in the system. This is done in Microsoft Dynamics Finance and Operations, through the Feature Management area in System Administration:

1. Navigate to System Administration.

2. Select Feature Management.

3. Search for “provisional” to find the relevant feature.

4. Enable “Provisional Ship Not Invoiced”.

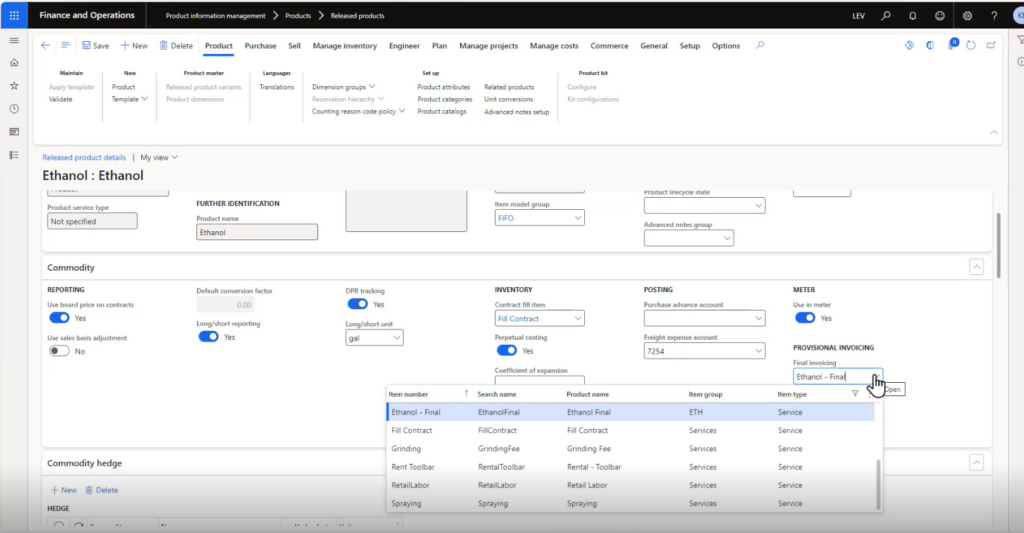

You must also set up the product configuration. Not all products will use provisional invoicing, so it must be configured on a per-product basis. For example, if you only want to provisionally invoice ethanol:

1. Go to Product Information Management.

2. Select Released Products and find your ethanol product.

3. In the product settings, enable provisional invoicing and specify the final invoicing item number.

This setup ensures that the product can be provisionally invoiced, and the final invoice will account for the difference between the provisional and final prices.

Creating a Provisional Invoice Contract

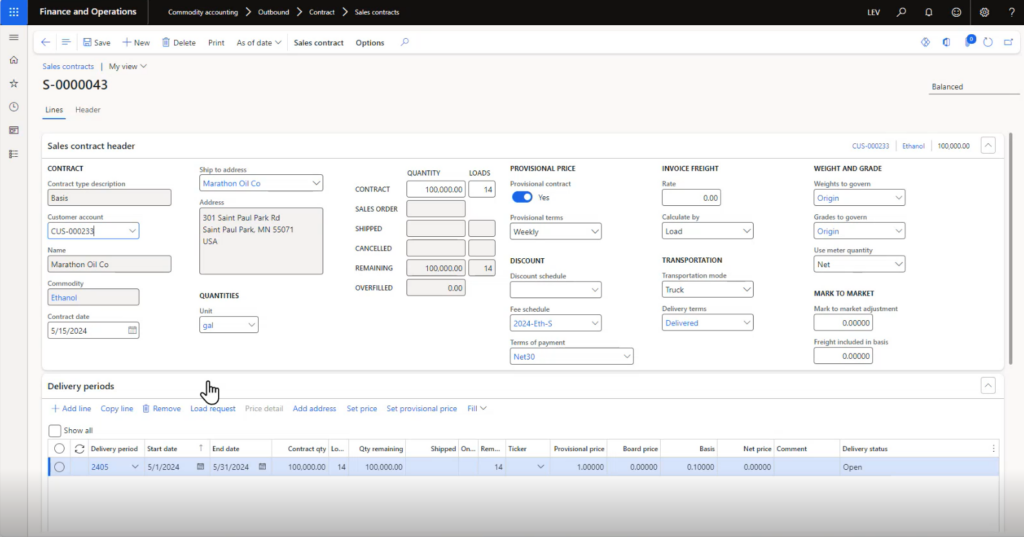

Once the setup is complete, you can create a provisional invoice contract through the following steps:

1. Go to Commodity Accounting.

2. Select Sales Contracts and create a new contract.

3. Choose a product like ethanol and a customer, e.g., Marathon Oil.

4. Specify the quantity and delivery details.

Provisional invoicing is typically used with basis contracts where the basis is set but the board price may vary.

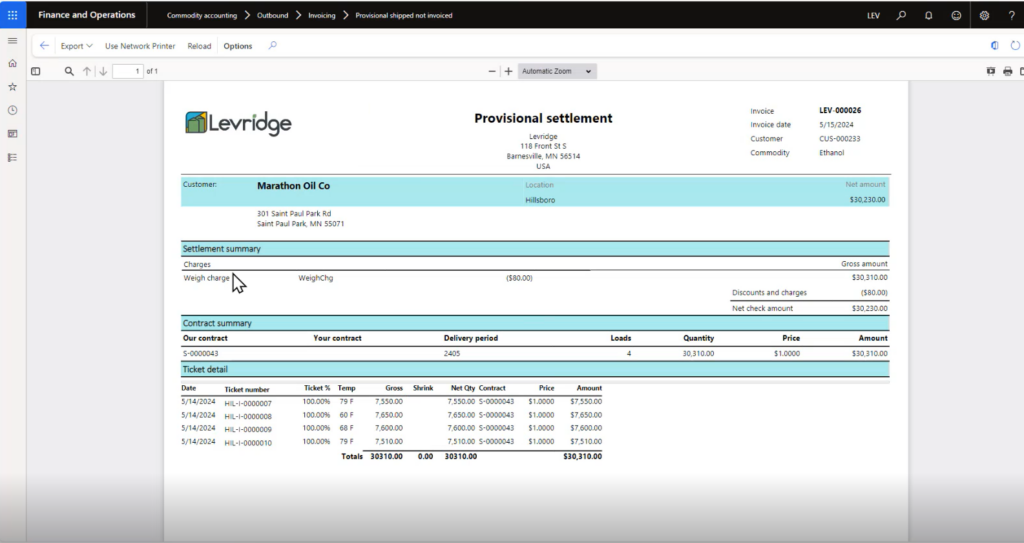

Provisional Invoicing Process

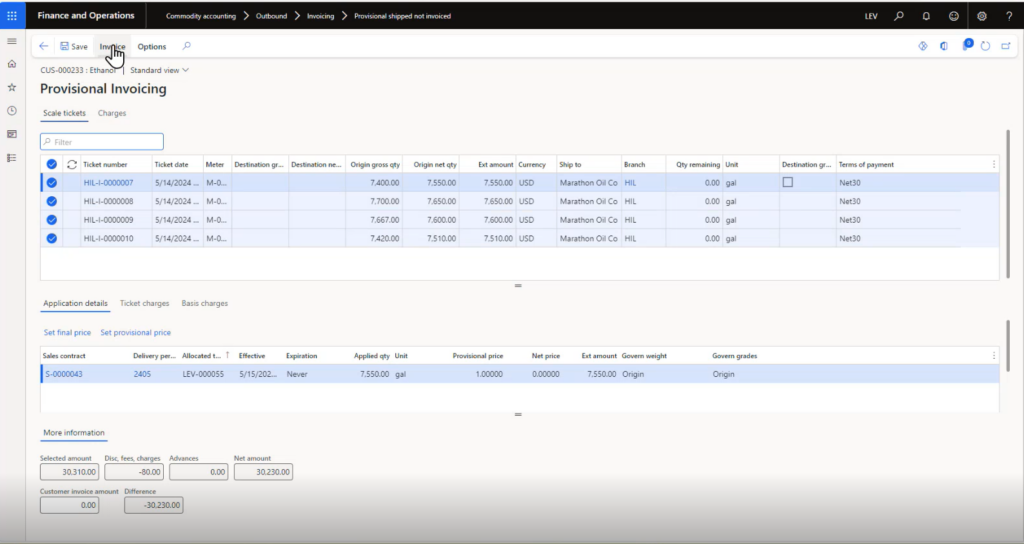

After setting up the contract, the initial step is to issue a provisional invoice. This involves:

1. Shipping the product to the customer.

2. Creating a provisional invoice for a nominal amount at the time of shipment.

The provisional invoice reflects a preliminary amount based on current known values.

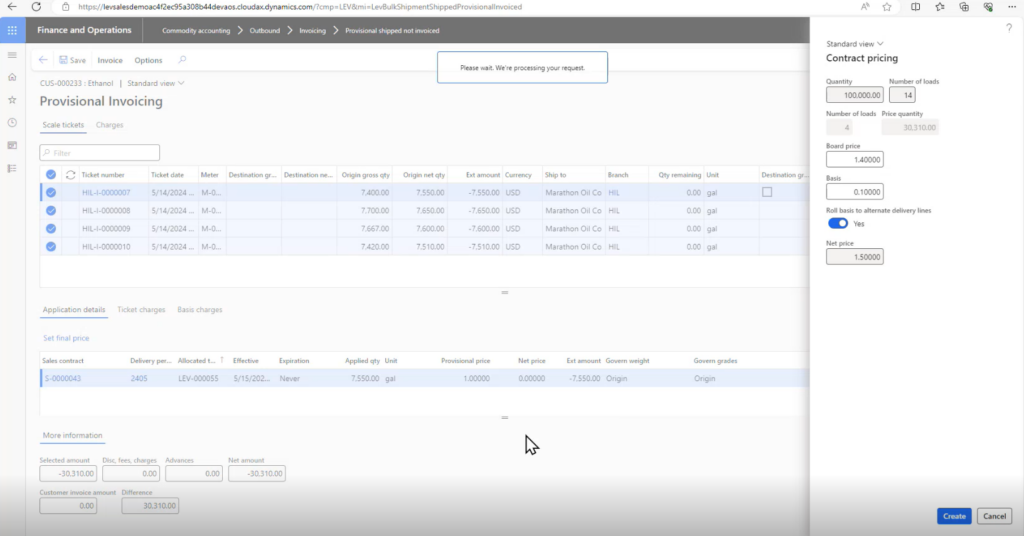

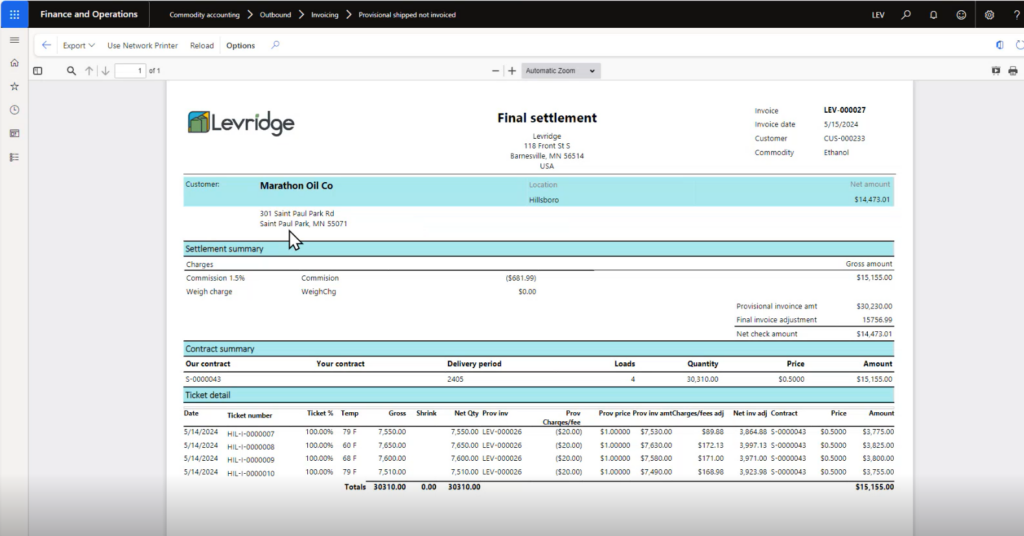

Final Invoicing

Once the final price is determined, a final invoice is issued to account for the difference between the provisional amount and the actual price:

1. Set the final price once the delivery period is over.

2. Generate a final invoice that calculates the difference.

For example, if the provisional price was $1.00 per gallon and the final price is $1.50, the final invoice will reflect an additional $0.50 per gallon.

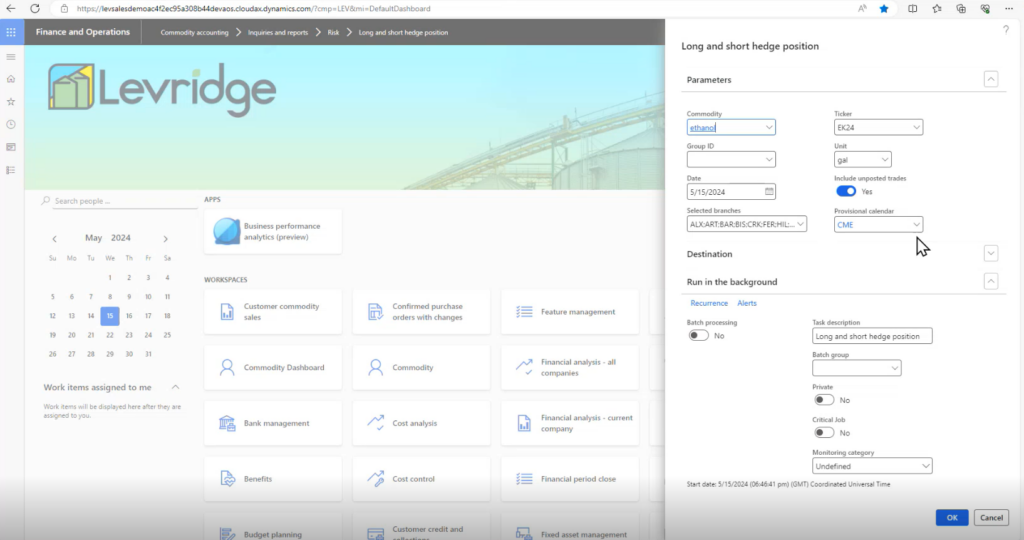

Managing Risks with Provisional Invoicing

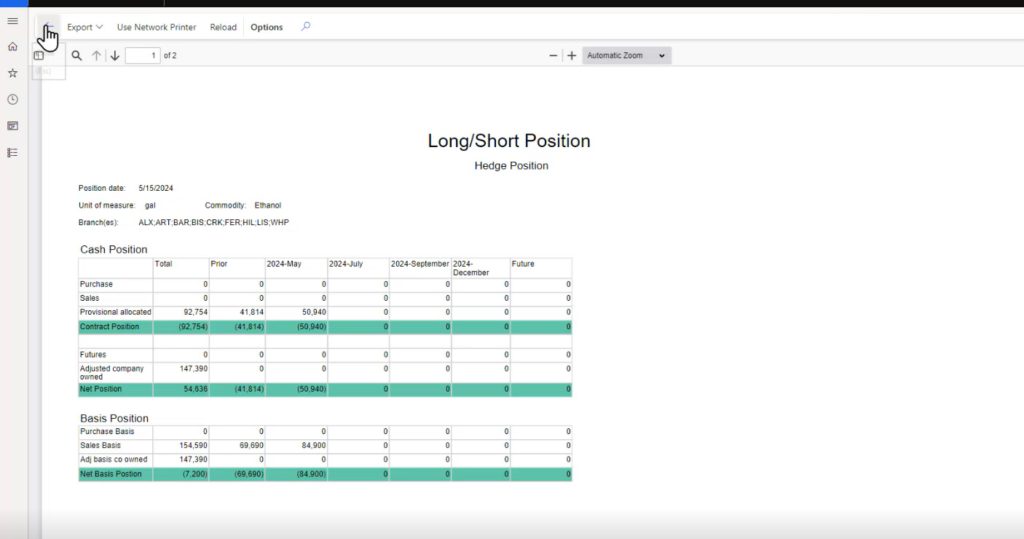

One of the advanced features of Levridge 2024R1 is its ability to manage the risks associated with provisional invoicing. This is achieved through integration with the long-short hedge position:

1. Go to Commodity Accounting.

2. Select Inquiries and Reports under Risk.

3. View the Hedge Position Report.

The system uses a provisional calendar, like the Chicago Mercantile Exchange calendar, to allocate a portion of unshipped, provisionally invoiced contracts to the cash position. The calendar is crucial as it helps in calculating the allocated quantity based on the number of market days in the delivery period.

Creating and Using a Provisional Calendar

A provisional calendar is essential for accurate risk management. Here’s how to set one up:

1. Create a new calendar in the system.

2. Define working times, ensuring to account for market open and close days.

For instance, if you set up a calendar for May, you need to ensure that it only includes days when the market is open. The system will automatically generate days and you can manually adjust to reflect open or closed statuses as needed.

Summary

Levridge 2024R1’s provisional invoicing feature is a significant enhancement for businesses dealing with products whose prices are finalized post-shipment. By enabling this feature through system administration and configuring it per product, companies can issue provisional and final invoices accurately. The integration with risk management tools ensures that businesses can also manage the financial risks associated with provisional invoicing effectively. This update not only streamlines the invoicing process but also provides robust tools for financial oversight and risk mitigation.

For businesses in the ethanol industry or similar sectors, leveraging provisional invoicing can lead to more accurate financial management and better alignment with market conditions, ultimately contributing to improved operational efficiency and profitability.