Broker Accrual and Invoicing

Broker fees are charges incurred when using a broker to facilitate the sale or purchase of commodities. These fees are typically calculated based on the volume of the commodity traded and are essential for accurately reflecting the cost of transactions.

The new enhancements in Levridge 2025 Release 1 allow users to accrue and later pay these broker fees, ensuring that all financial obligations are met promptly and accurately.

Setting Up Broker Fees

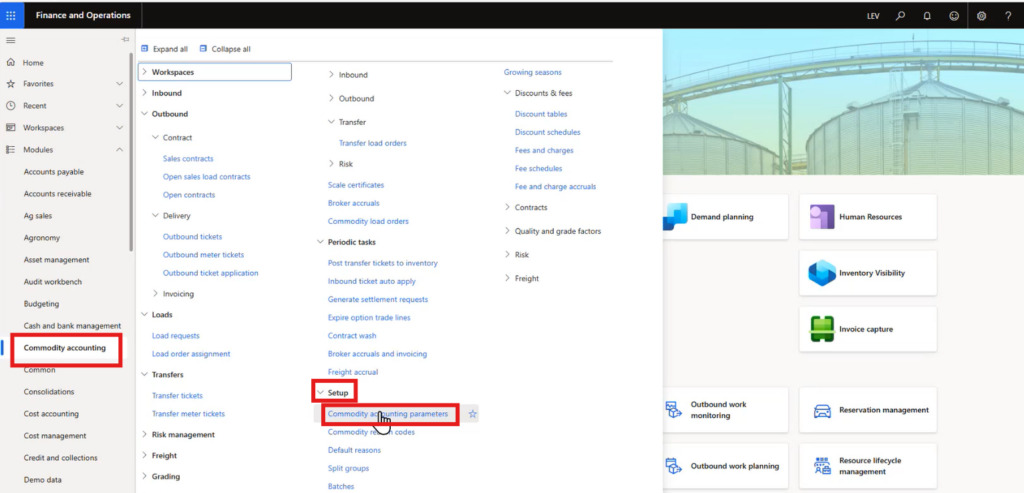

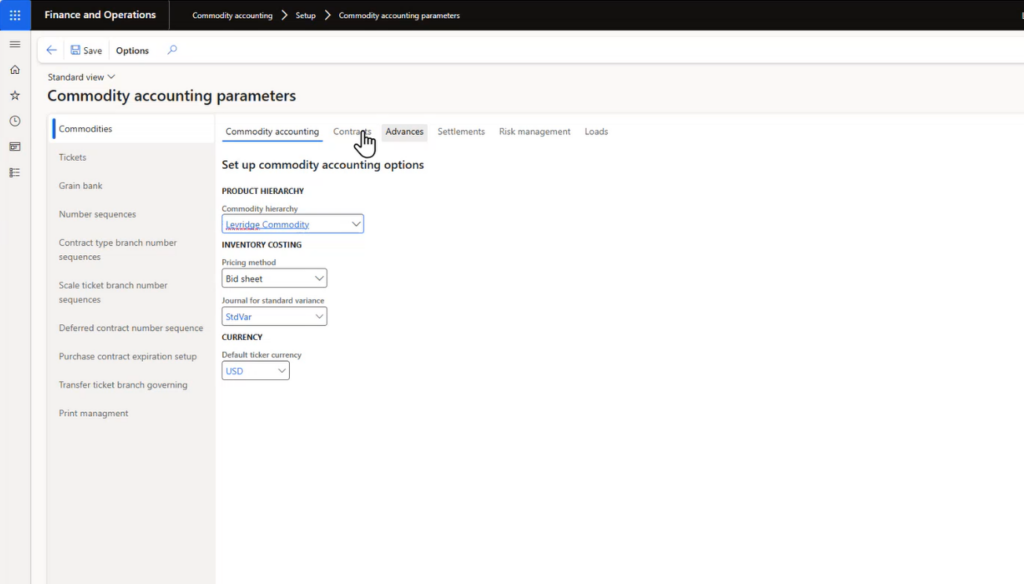

The first step in utilizing the new broker fee functionality is to enable it within the system. Users can navigate to the commodity accounting module, access the setup menu, and find the commodity accounting parameters.

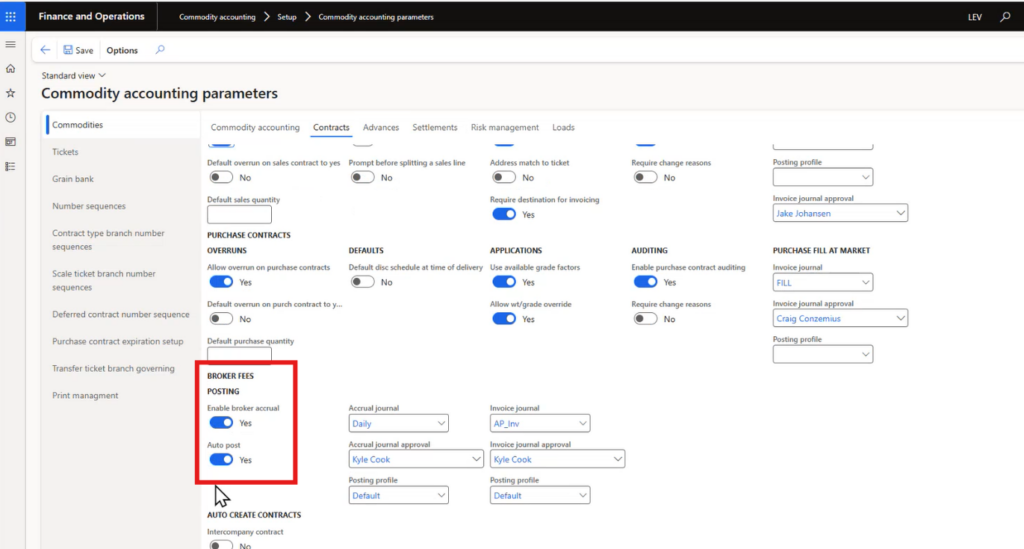

Under the commodities tab in the contracts, there is a new section called broker fees. Here, users can enable or disable broker accruals based on their needs.

When enabled, the system will automatically post accruals for broker fees to the general ledger. This is controlled by the automatic post setting, which ensures that broker fees are recorded as soon as they are calculated. Users can also define the invoice journal, approver, and posting profile, streamlining the process of paying broker fees when they become due.

Applying Broker Fees to Sales Contracts

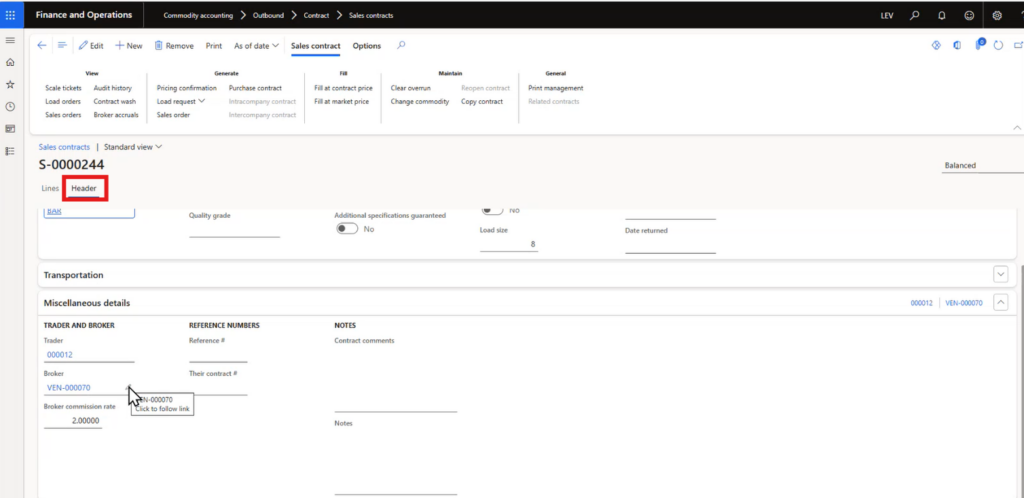

Suppose you have a sales contract for distillers grains with a broker fee of $2.00 per ton. When creating the sales contract, you can specify the broker and the commission rate under the miscellaneous details section of the contract header.

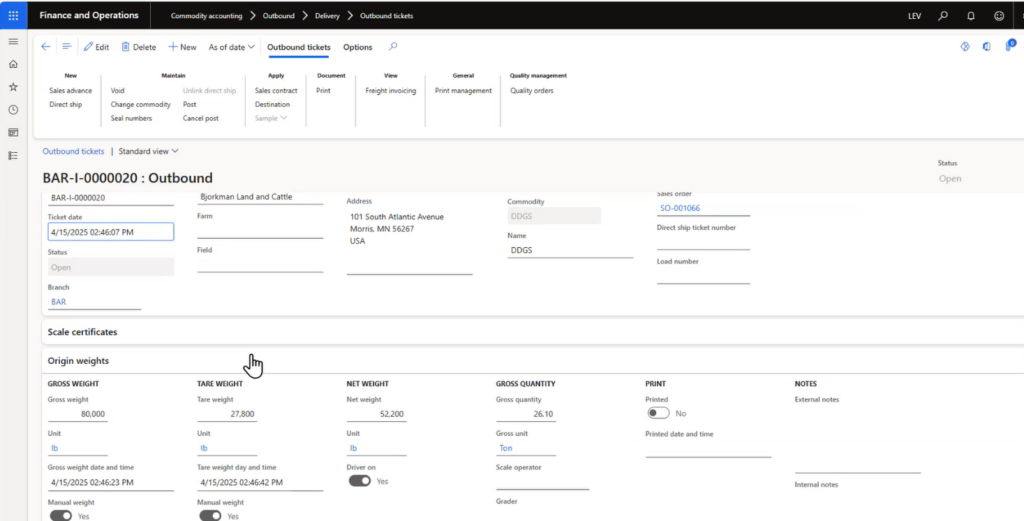

Once the contract is set up, the next step is to create an outbound ticket for the shipment of the commodity. For example, if you ship 26.1 tons of distillers grains, the system will record this shipment on a scale ticket. At this point, no broker fees are accrued because the ticket has not yet been applied to a contract.

Accruing Broker Fees

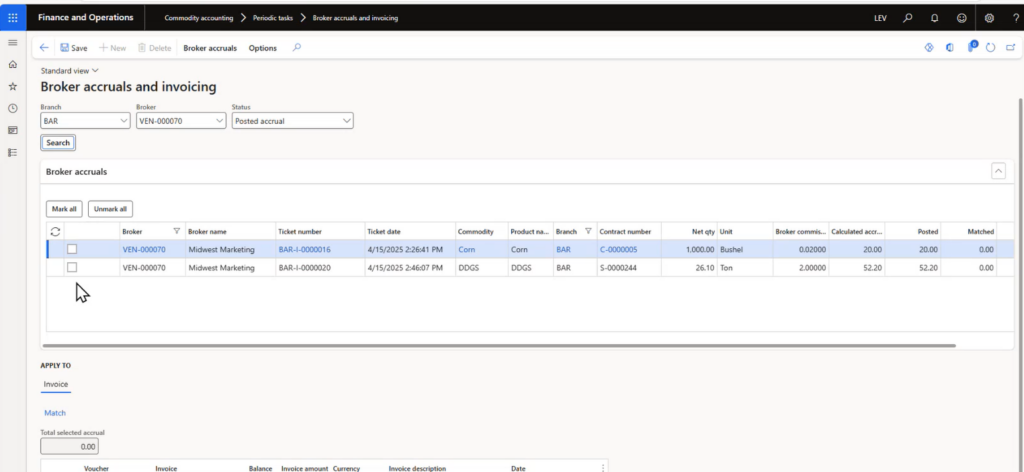

To accrue the broker fees, you need to apply the scale ticket to the sales contract. This process updates the inventory and calculates the broker commission based on the specified rate. In our example, applying the ticket to the contract will result in an accrual of $52.20 for the broker fee (26.1 tons at $2.00 per ton).

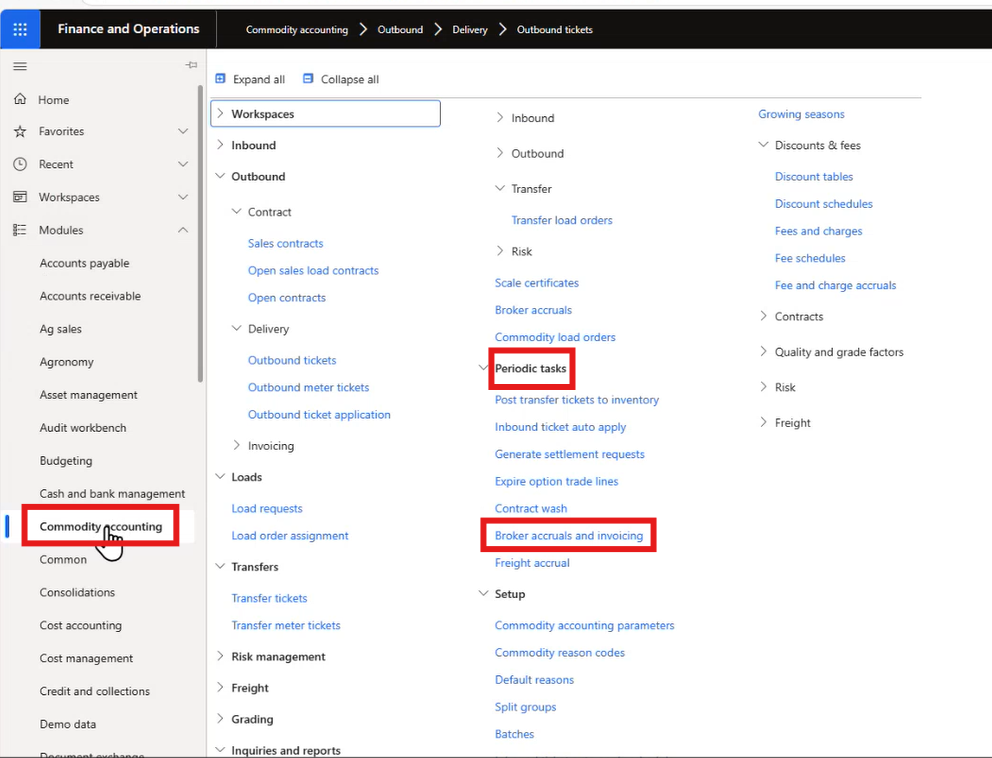

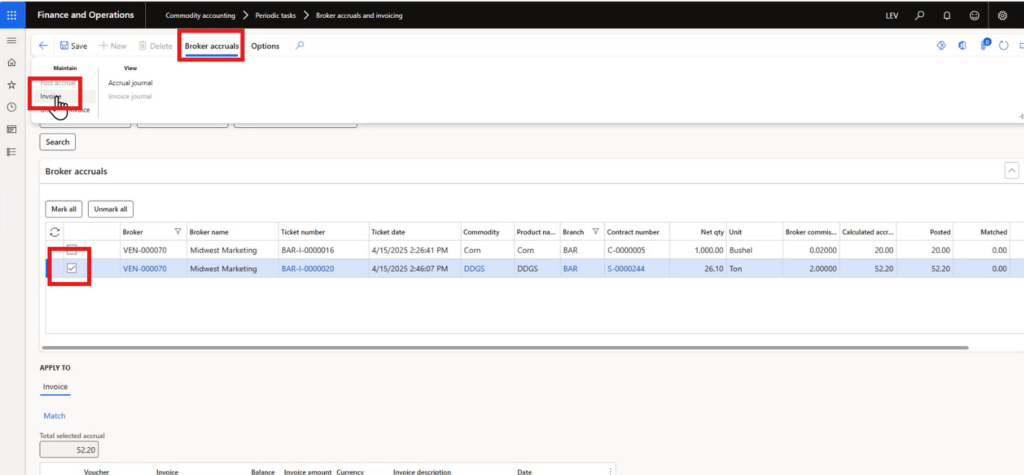

Users can review the accrued broker fees by navigating to the broker accruals and invoicing section under commodity accounting. Here, you can select the relevant broker and view the accrued fees for each ticket. This transparency ensures that all broker fees are accurately tracked and accounted for.

Invoicing and Paying Broker Fees

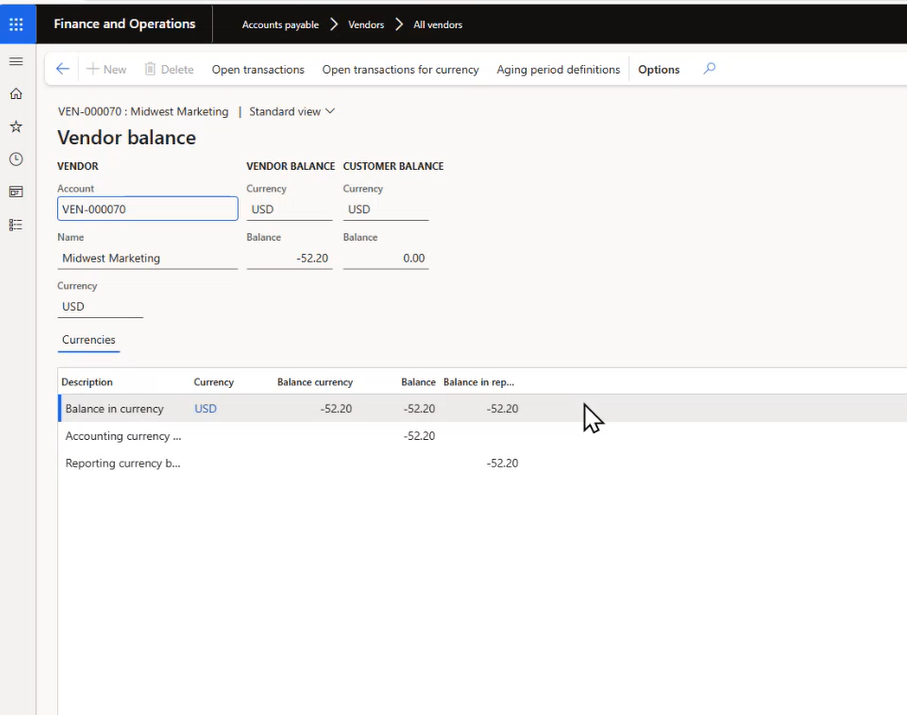

The final step in the process is to create a vendor invoice for the accrued broker fees. Users can select the accrued fees they wish to invoice and generate a vendor invoice using the specified invoice journal. This invoice is then ready to be paid through the standard accounts payable functionality in Dynamics 365.

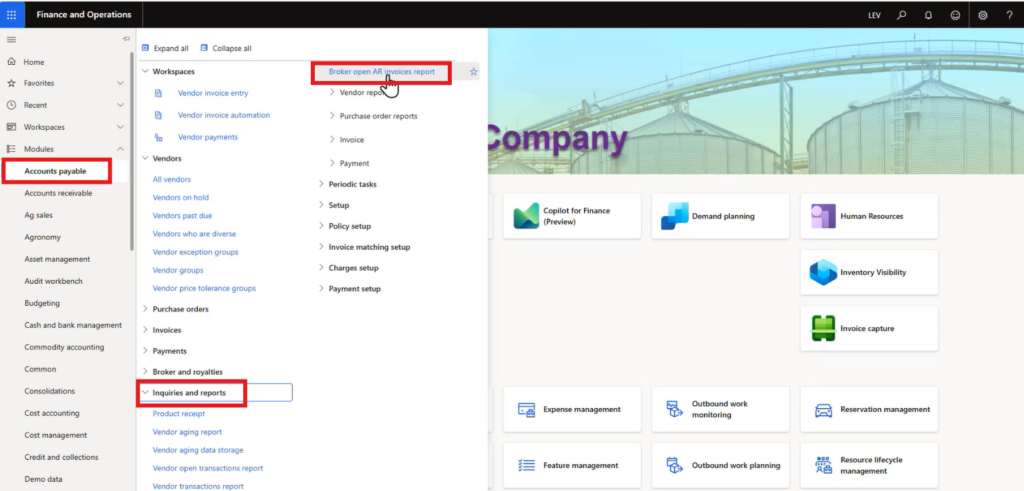

The invoice will appear in the accounts payable module, ready to be processed and paid.

This same functionality that has been shown on the sales side also works on the purchase side at the time it is applied to the purchase contract.

Reporting and Analysis

Levridge 2025 Release 1 also includes enhanced reporting capabilities for broker fees. Users can generate reports to view open broker accruals and invoices, providing a clear overview of all outstanding broker fees.