Commodity Long and Short Position: Delivery vs Hedge

Levridge has designed and developed two versions of the Commodity Long and Short report. A Delivery position where the position month is based on the delivery period that is on the contract line. This version is a great source for inventory management to help keep visibility on a commodity and show what will delivered or shipped in each calendar month. The other version is Hedge position which has the position month based on the hedge month and year on the contract. Main purpose of this report is to see the market risk position for each hedge month/year.

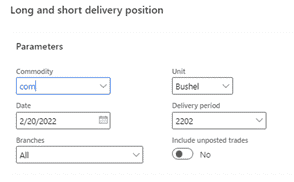

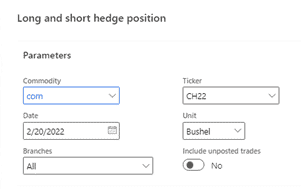

When running the report the parameters are commodity, position date, branch (one or more), and unit of measure which defaults to what is on the commodity. The last parameter is based on what position report is running. The delivery position will have a delivery period that will default to the period of the current date. The hedge position will have a ticker which will default to the ticker with a month/year for the current date.

Each version of the report will have buckets created for a time period based on the position date entered.

- Total: the first bucket is the total bucket which sums up all columns in the row

- Prior: Based on the position that is running this bucket holds quantity for delivery periods or hedge month/year that comes before the position date that is selected

- Months: After prior there will be up to twelve buckets for the months after the position date entered. As long as there is a delivery period or ticker for the month/year created in the system.

- Future: same as prior except it holds quantity for the delivery period or hedge month/year past the last month bucket.

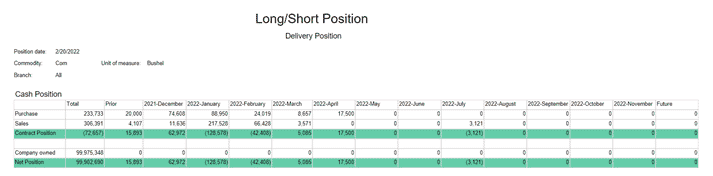

DELIVERY POSITION

The delivery position is made up of one main section called Cash position which is made up of contract position and net position.

- Contract position: there will be a row for purchase and sales contracts that will have the total quantity for the period bucket. Then a total row that shows the contract position. The total row will take the purchase quantity and subtract the sales quantity which will show if there is a negative or positive position for the bucket month/year. This will be a good indicator if there are sales contracts that do not have enough inventory from purchase contracts to fill.

- Net position: this section will also include the company owned inventory and then subtract that total from the contract position giving you the net position for bucket month/year

- Company owned: this is the total inventory quantity that is company owned. Meaning it has been applied to a purchase contract or has been settled and/or paid.

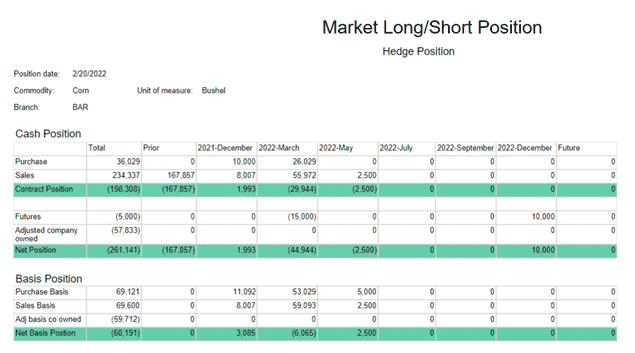

HEDGE POSITION

The hedge position contains two sections called Cash position and Basis position. The contract position is similar to what was laid out above. This version also will include future trade quantities and a section for the basis contracts.

Cash Position:

- Contract position: this section is the same as the delivery position version except that it will only include contracts where the board price is not equal to zero or if the contract is setup to not require a board price.

- Futures: this is the quantity from future trades. The total number of open contracts will be used to determine the total quantity based on what is on the ticker.

- Adjusted company owned: The Company owned quantities for hedge position differs some from the delivery position. For this version the quantity from basis and price later delivered contracts are removed from the company owned inventory.

Basis Position:

- Purchase and Sales Basis: these rows will contain quantity from contracts delivery period lines where the basis price is not zero or if the contract doesn’t require a price.

- Adjusted company owned: This is similar to the adjusted company owned in the Cash position except that the quantity for the basis delivered contacts gets added back to the company owned inventory.

- Net Basis Position: this is calculated by taking the purchase basis and subtracting the sales basis and adjusted basis company owned.

Below is a screen shot of the report parameters for delivery and hedge positions