Your Guide to Posting Accounts for Commodity Accounting in Levridge

There are several posting accounts needed for commodity accounting when processing inbound and outbound tickets and settlements. This blog outlines each place posting accounts are needed and when they will be used.

Inbound Tickets

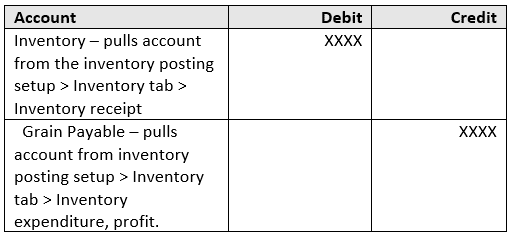

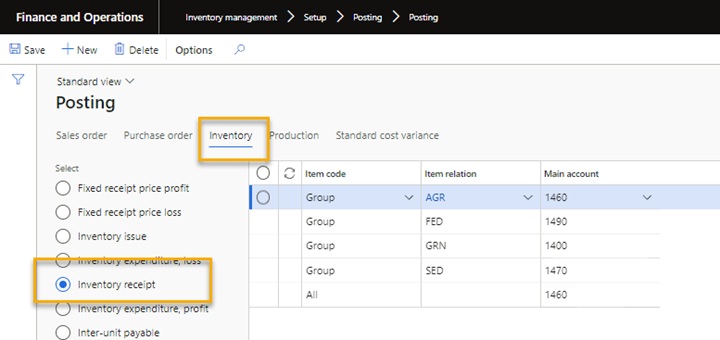

When an inbound ticket is applied to a purchase contract, the system creates and posts an inventory adjustment. This follows the same posting as any FinOps inventory adjustment:

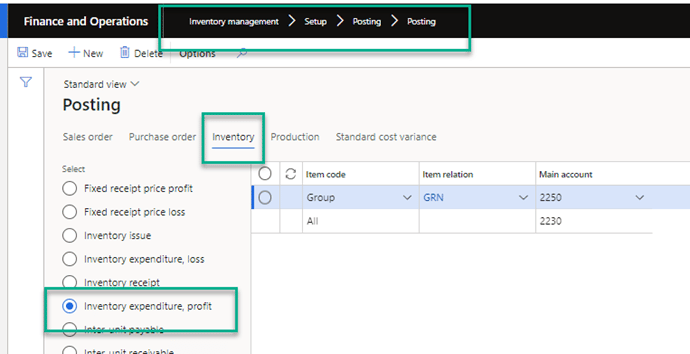

If the inventory is increasing it uses the inventory posting setup Inventory tab and posts to the Inventory receipt and Inventory expenditure, profit. Note nothing will post if there is no cost on the released item.

Circled in green: Inventory management > Setup > Posting > Posting; Inventory; and Inventory expenditure, profit

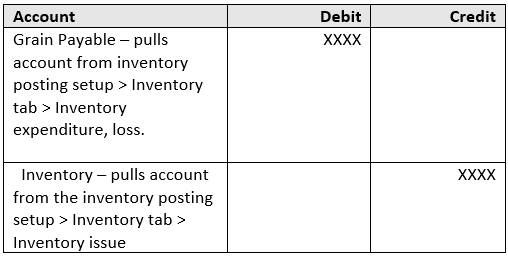

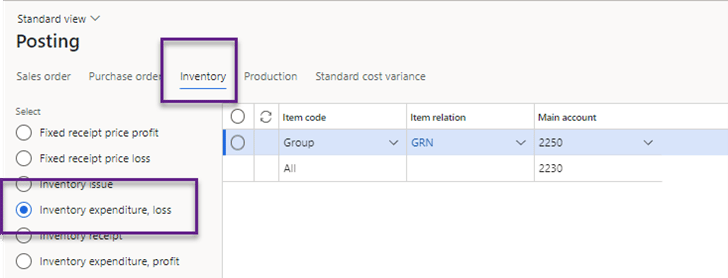

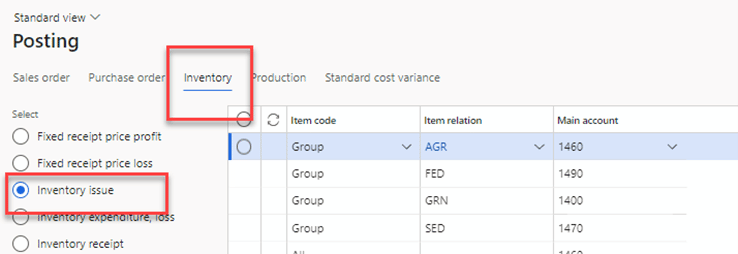

When posting a shrink it also uses inventory adjustments and since it is decreasing inventory it uses the Inventory issue and Inventory expenditure, loss. The Inventory issue and Inventory receipt accounts are the same account generally an inventory account and the Inventory expenditure, profit and loss are also the same account generally the grain payable.

Inventory and Inventory receipt are circled in yellow

Inventory and Inventory expenditure, loss are circled in purple

Inventory and Inventory issue are circled in red

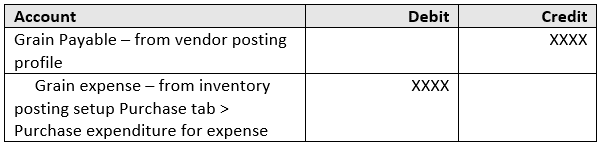

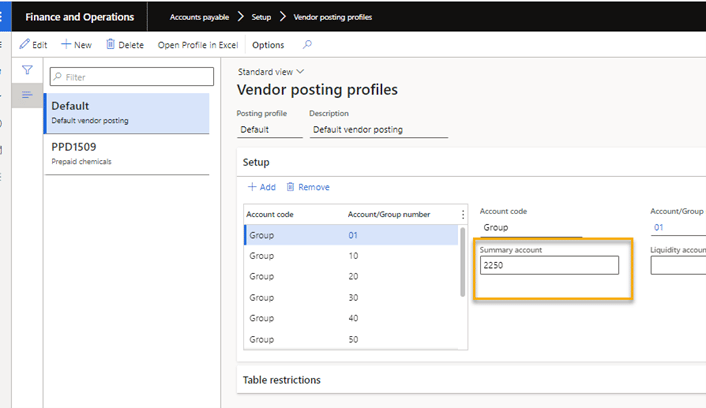

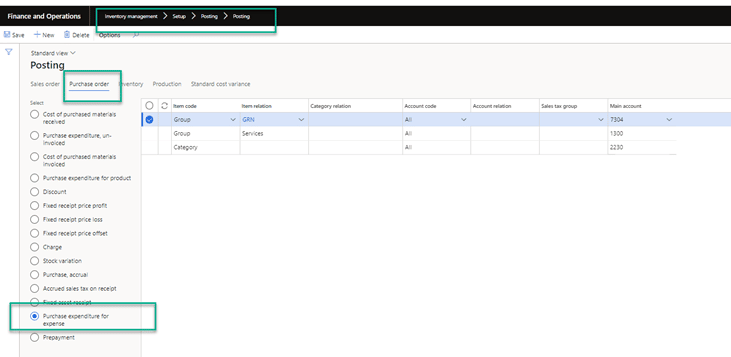

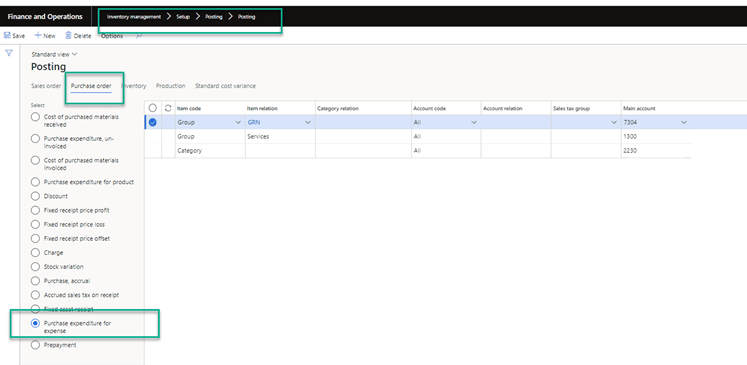

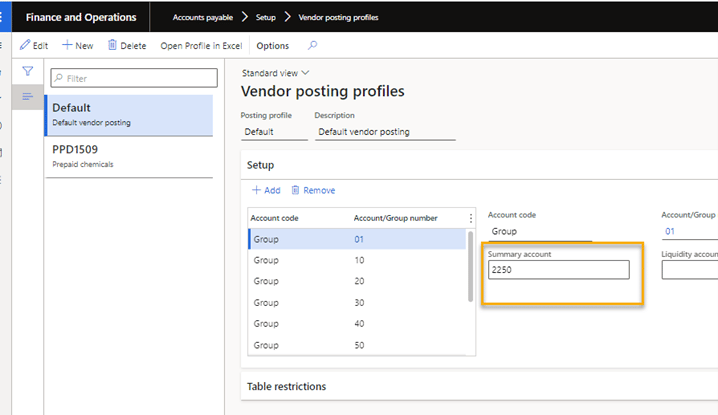

Inbound Settlements

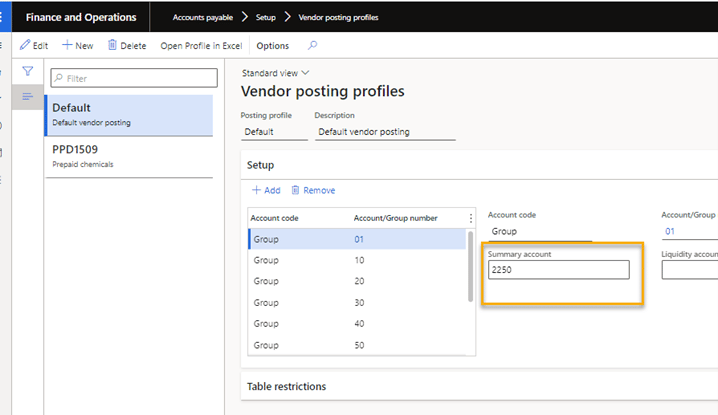

When the inbound settlement is confirmed, the system creates and posts a vendor invoice journal. The system uses the vendor posting profile for the payables account for the credit (in the yellow callout on the below snapshot) and the offset will be pulled from inventory posting setup under Purchase order tab and the Purchase expenditure for expense (called out in green on the below snapshot). The discount offsets are called out in the Discount section in this document.

Summary account is entered as 2250 and is circled in yellow

Circled in green: Inventory management > Setup > Posting > Posting; Purchase order; and Purchase expenditure for expense

Inbound Settlement Payments

When the inbound settlement is confirmed, the system creates and posts a vendor invoice journal. The system uses the vendor posting profile for the payables account for the credit (in the yellow callout on the below snapshot) and the offset will be pulled from inventory posting setup under Purchase order tab and the Purchase expenditure for expense (called out in green on the below snapshot). The discount offsets are called out in the Discount section in this document.

Summary account is entered as 2250 and is circled in yellow

Circled in green: Inventory management > Setup > Posting > Posting; Purchase order; and Purchase expenditure for expense

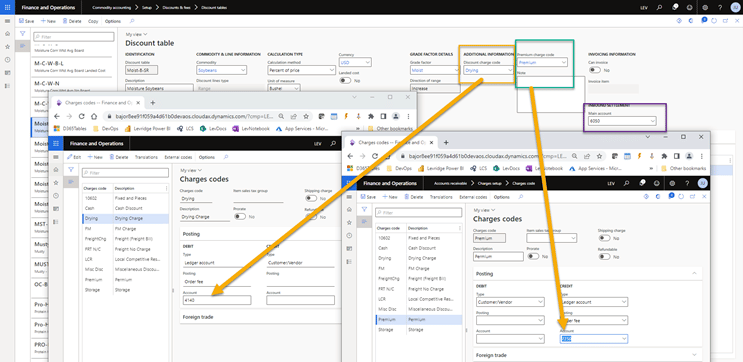

Discounts

Discount charge code (under additional information) is “Drying”. This is circled in yellow and pointing to a Charges codes tab where the account is 4140. Premium charge code is selected as “Premium”. This is circled in green and pointing to a Charges codes tab where the account is 7250. Main account (under Inbound settlement) is 6050 and is circled in purple

For outbound settlements (called out in yellow on the above snapshot) the system will use the discount charge code from the discount table to add a charge code to the sales order line for that grade discount. The system then uses the AR charge code account to reduce the amount the customer owes for that ticket. This is typically a grade discounts revenue account.

If the grade results in a premium (called out in green on the above snapshot) which adds to the amount the customer owes it will also pull from AR charge codes in the Premium charge code field. This is typically a grade premium account.

For inbound settlements (called out in purple on the above snapshot), the system will create and post a vendor invoice journal when a settlement is confirmed. It will look to the main account in the inbound settlement group on the discount table to post the offset account on that vendor invoice journal. This is typically an income account. Often there will be different accounts for the moisture discount and the other discounts will post to a different account for all of the other grades. For example, Moisture posts to 6050 – Drying income and FM posts to 6060 – for grain discounts revenue. But each discount could have its own account if desired.

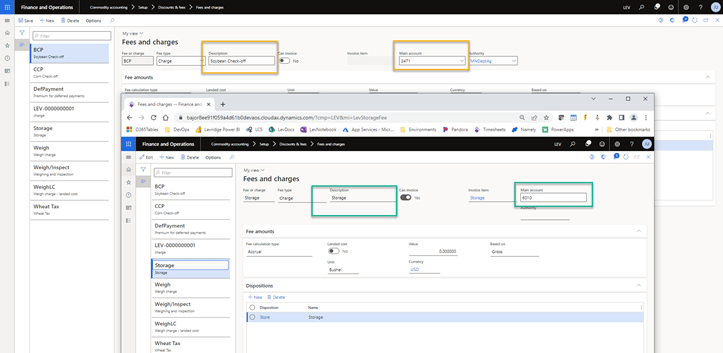

Fees and Charges

“Soybean check-off” is written under Description and is circled in yellow. The main account is listed as 2471 and is also circled in yellow. A second Fees and charges tab has “Storage” as the description. This is circled in green. The main account is listed as 6010 and is also circled as green.

Fees and charges are assessed to tickets but are not grade-based. Such as checkoff assessment for wheat, beans, and corn. These will also post during inbound settlements to a payable account if the fee is owed to someone else (called out in yellow in the above snapshot). If the fee is for storage or weighing charge, the account is usually a revenue account called out in green in the above snapshot).

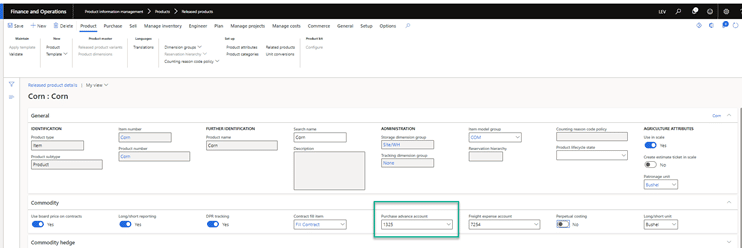

Purchase Advances

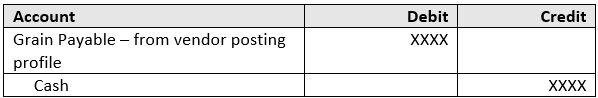

When a purchase advance is confirmed a vendor invoice is created and posted. The system will use the vendor posting profile for the credit account and look to the released item for the debit. The vendor posting profile should have a different summary account for commodity vendors such as 2250 for grain payable. Non-commodity vendors would have the standard accounts payable account. This is done by using the vendor groups on vendor posting profile.

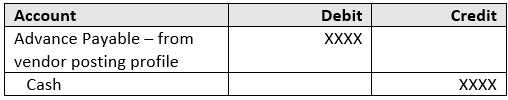

Then when the purchase advance is paid, it will post a debit to the vendor posting account (for example 2250) and credit the cash account.

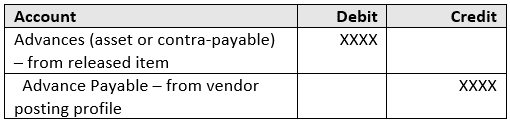

Purchase advance confirmed:

Purchase advance payment:

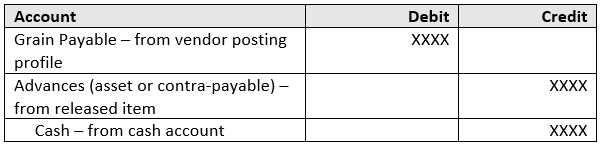

Inbound settlement confirmed:

Summary account is 2250. This is circled in yellow.

Circled in green: Purchase advance account is 1325

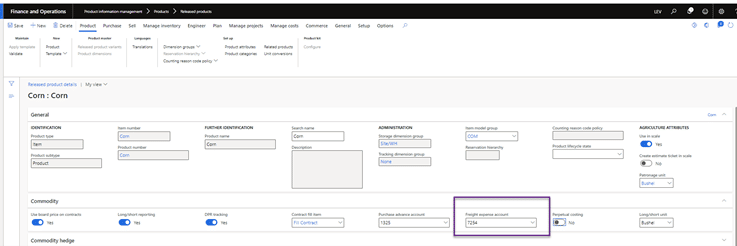

Freight

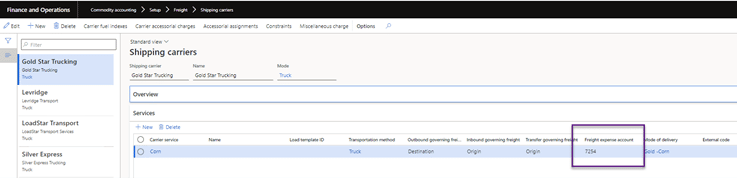

The freight expense account can be found in many different places. First it will look to the released item in the commodity fast tab, if not there It will look to the shipping carrier-carrier service (snapshots below).

Circled in purple: Freight expense account is 7254

Circled in purple: Freight expense account is 7254

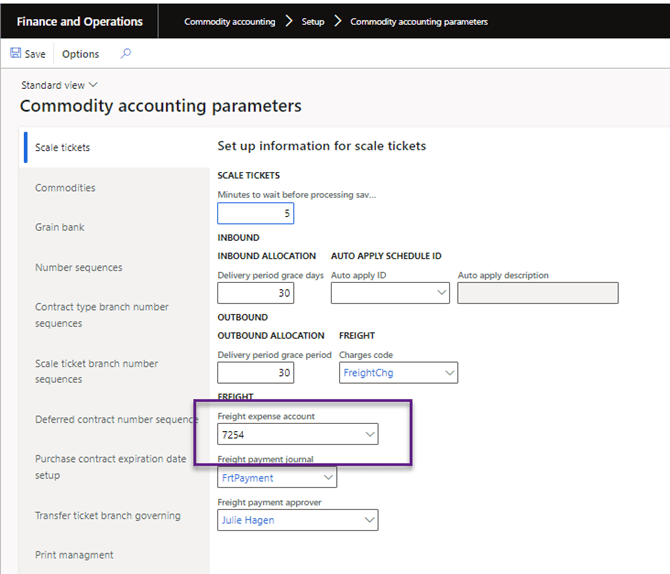

If it doesn’t find an account in either of those 2 places it will look to commodity accounting parameters.

The scale tickets tab is selected. Freight expense account is 7254 and circled in purple