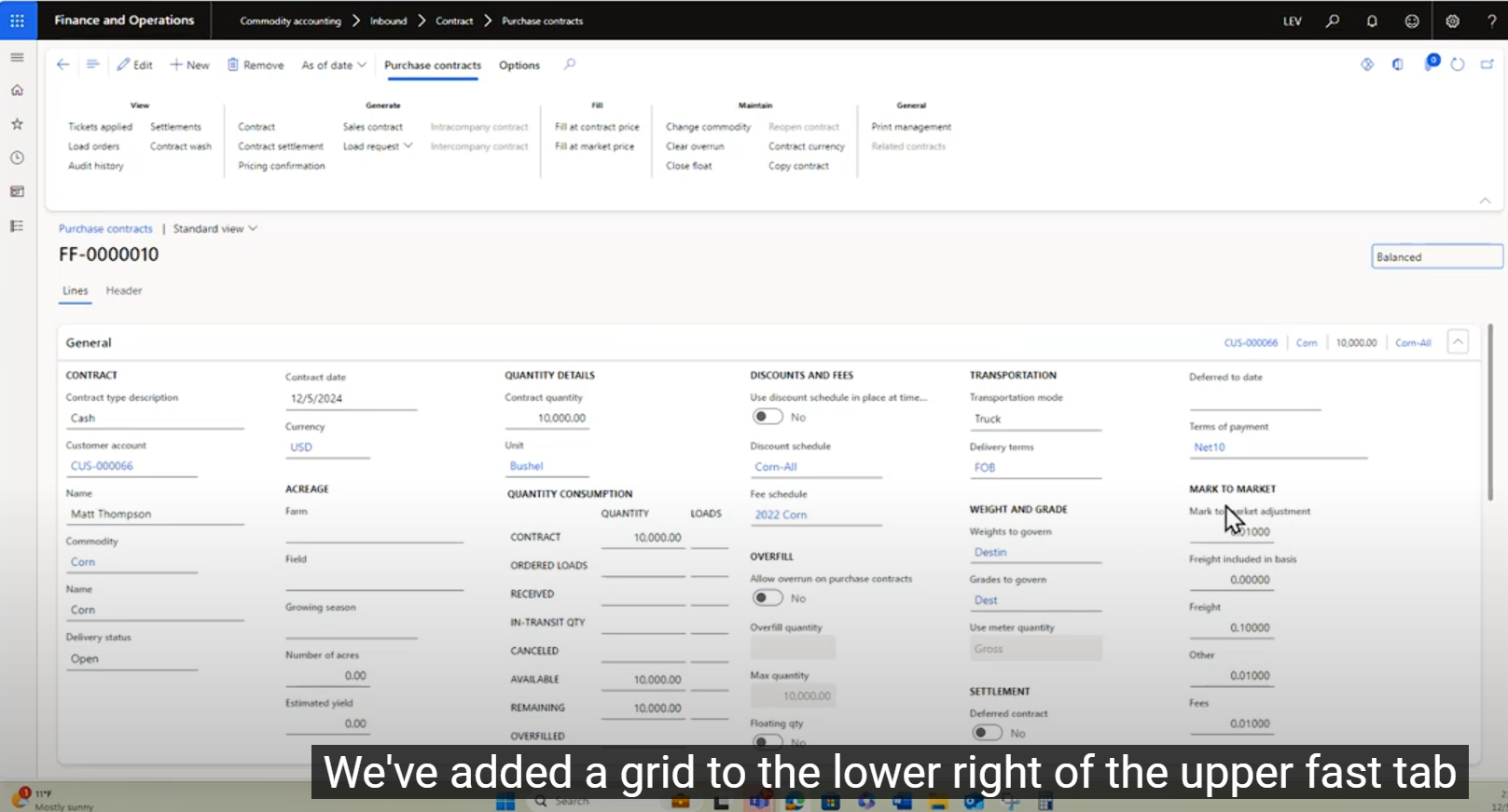

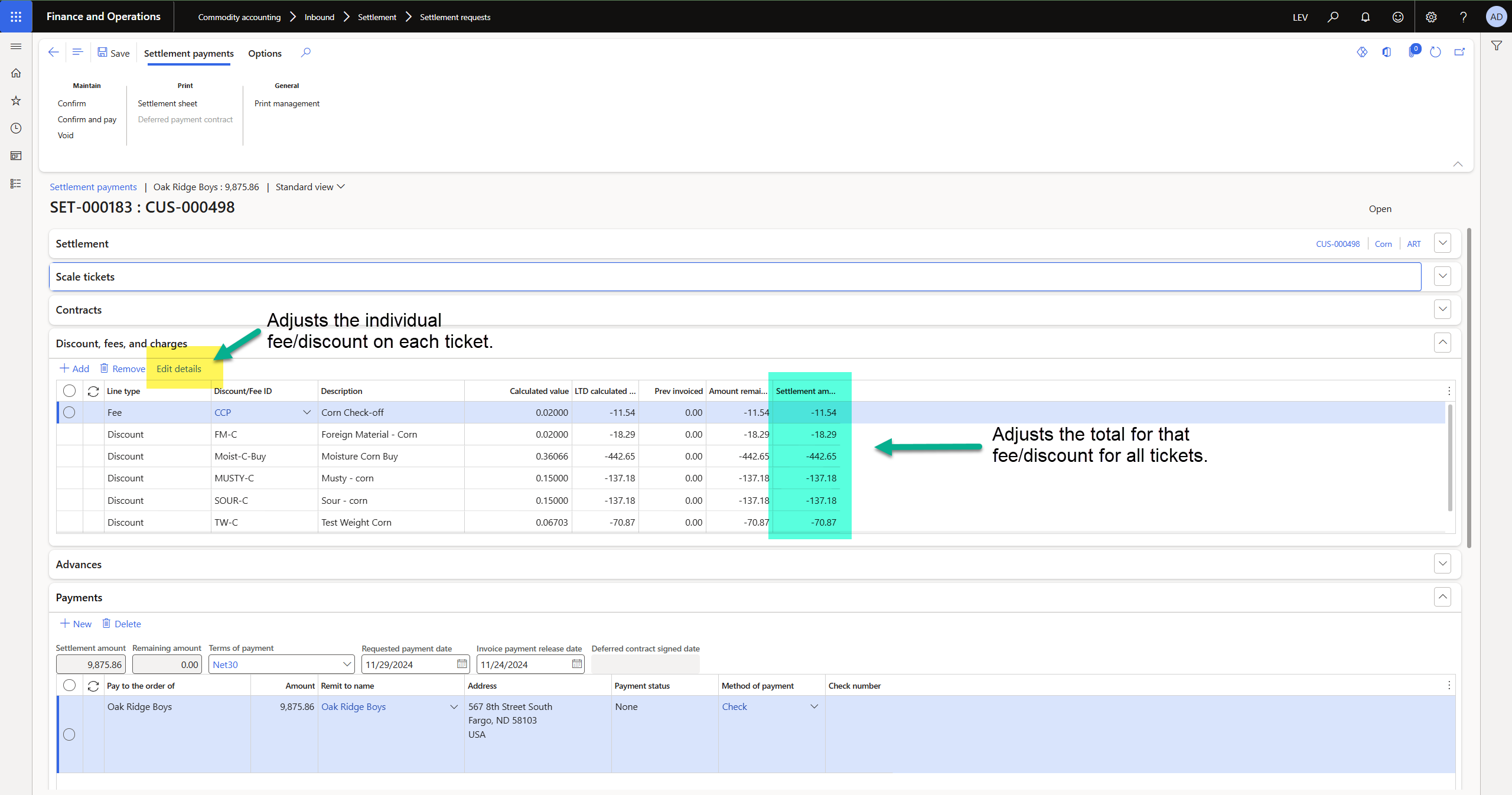

In the latest Levridge release, R3 2024, Mark to Market adjustments have been enhanced to include up to 10 user-defined adjustments on commodity contracts.[…]

In the latest Levridge release, R3 2024, Mark to Market adjustments have been enhanced to include up to 10 user-defined adjustments on commodity contracts.[…]

Levridge 2024 Release 3.0 is now available! Finishing the year strong[…]

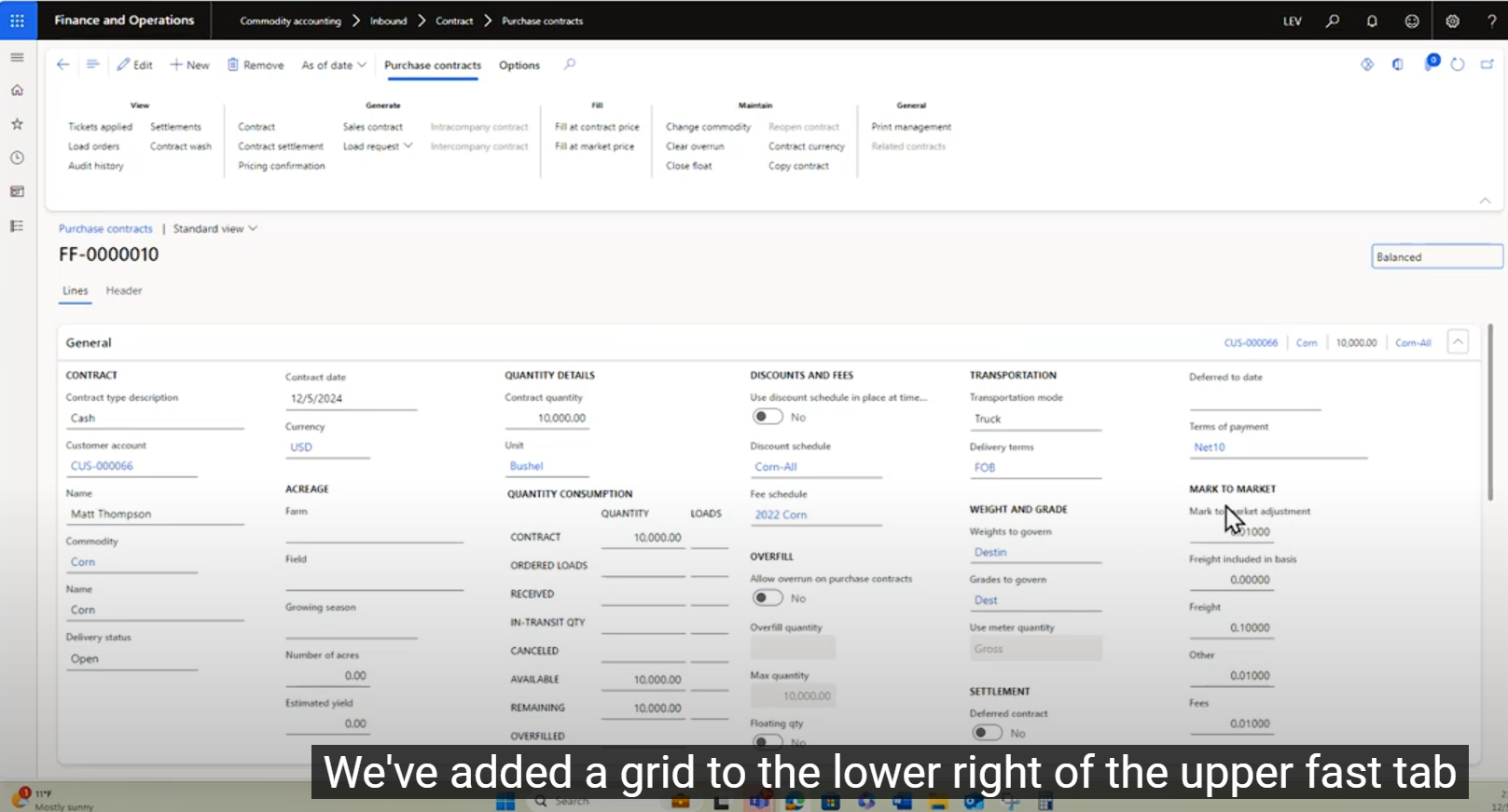

Effective commodity trading requires diligent tracking and analysis of expired trades. Levridge’s filtering feature simplifies this process, allowing you to isolate expired options trades quickly and focus on active strategies. […]

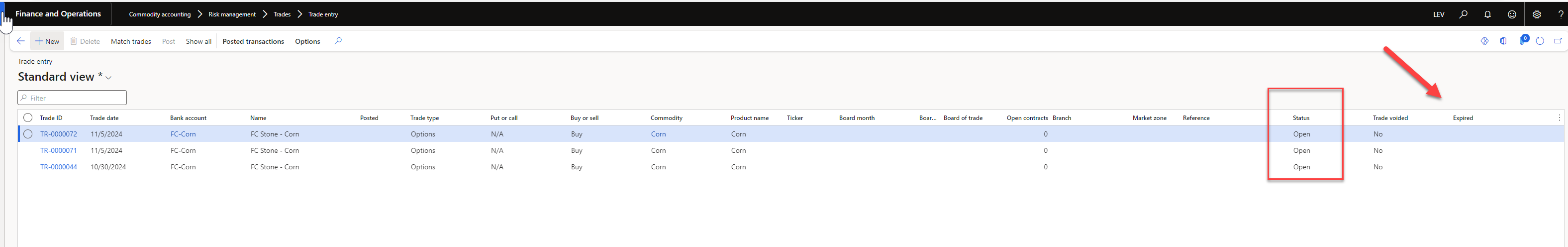

The Levridge Commodity Accounting module provides two methods to edit settlement discounts and fees on the settlement payment detail […]

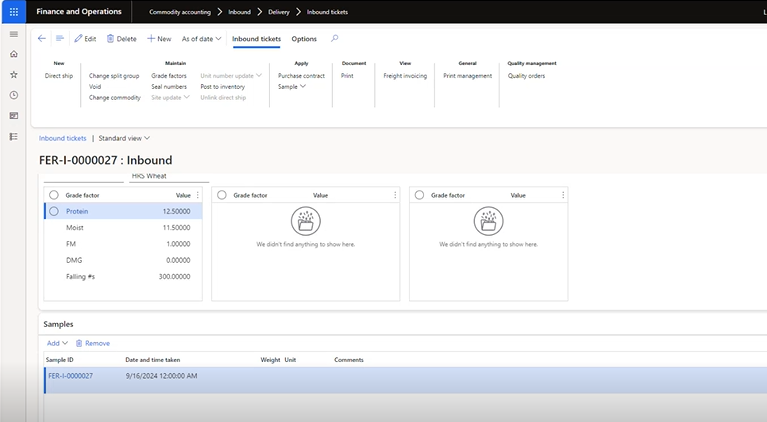

In Levridge 2024 Release 2.0, a series of improvements have been introduced that significantly enhance how inbound tickets are managed, especially with the inclusion of discount schedules.[…]

Levridge Commodity Accounting 2024 release 2.0 supports multicurrency transactions in mark-to-market gain and loss calculations.[…]

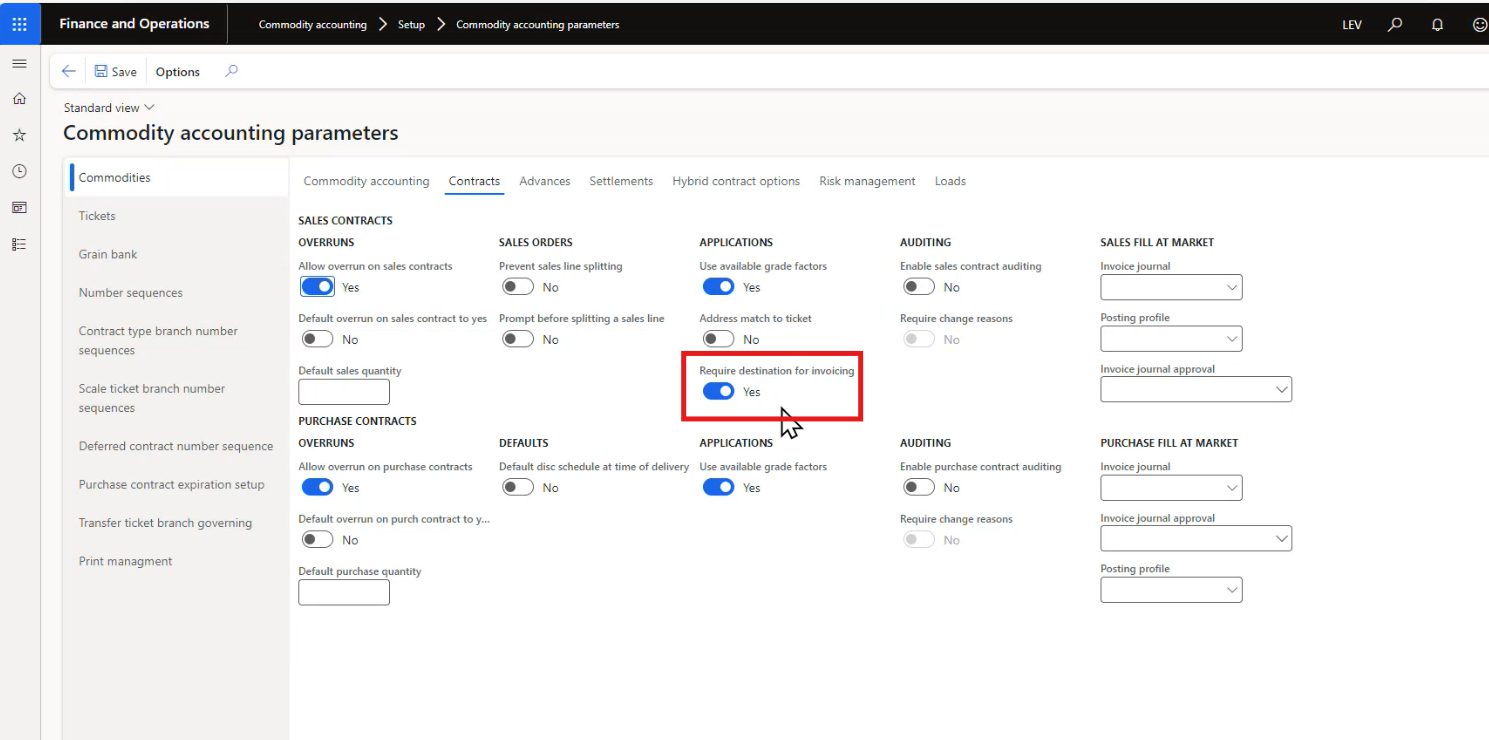

Levridge 2024 Release 2.0 solves this problem by introducing the ability to update destination weights and grades on an outbound ticket without having to unapply and reapply the sales contract.[…]

The addition of composite grades in Levridge 2024 Release 2.0 enables users to apply a single grade across multiple tickets, it streamlines the grading process, enhances accuracy, and saves both time and money[…]

The addition of composite grades in Levridge 2024 Release 2.0 allows users to duplicate and modify quality grades with ease. This feature saves time, reduces errors, and adds flexibility to commodity management. […]

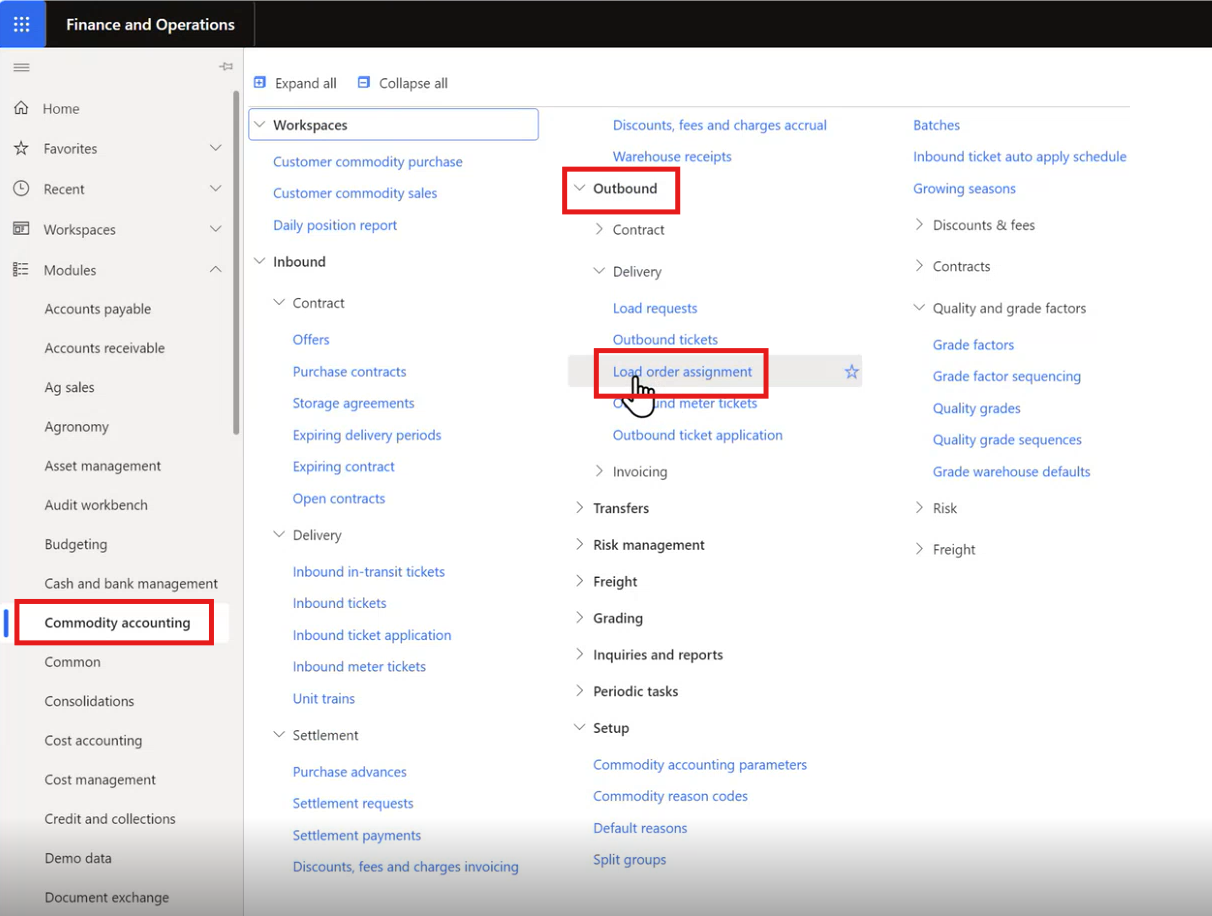

Levridge 2024 Release 2.0 introduces new features to enhance the creation, modification, and cancellation of load orders, providing more control and ease of use[…]